44+ what not to do when applying for a mortgage

Whether its on your laptop desktop or smartphone many lenders offer options to apply for a mortgage online. Web Prepare to submit a mortgage application 6 steps to applying for a mortgage Step 1.

3 Bedroom Duplex W Sea View Ajar Vacation Rentals In Lebanon

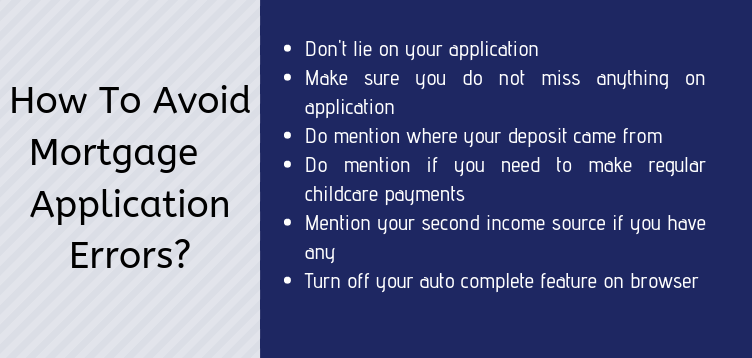

Dont apply for new credit.

. Your debt-to-income ratio or how much debt youre paying off each month in comparison to how much money youre making is just one factor that lenders look at when reviewing your mortgage application. Web Taking on additional debt before applying for a mortgage doesnt make much sense. This is because mortgage lenders examine.

Still it helps to know whats coming so you can. Web Before filling out the mortgage application its smart to collect the necessary documents and information ahead of time particularly if a mortgage lender is assisting you in person or by phone. Switching or quitting your job.

Even if you currently have an excellent credit score and feel confident of your ability to qualify for more credit resist applying for any credit cards for a period of three to six months before making a mortgage application. As a general rule wait until after you close on the mortgage to consider big purchases. Many lenders allow borrowers to apply by phone.

Because the down. Web Loan Application Information Required. Your loan officer must track the amount as well as the source of your annual income.

Obviously this can be a tall order during a pandemic and economic downturn but another major mistake is changing jobs. Web In a recent NerdWallet study 44 of respondents said they believe you need to put 20 or more down to buy a home. Changing jobs either before or during the mortgage process could interfere with getting.

The type of mortgage you need will vary based on your circumstances so its important to think. Web You will list on your mortgage application all monthly debt payments auto and student loans credit cards existing mortgages and assets such as bank and investment accounts. Web There are three basic steps to apply for a mortgage.

Fill out a mortgage application Step 2. Your signature indicates all information is correct on the application and when it isnt up to date that can wind up hurting you in the long run. Web If you have a score of 580 or higher you only have to put down 35.

Youll need to verify your annual income which means supplying tax returns recent pay stubs or other proof of. Here are four things you should not do after submitting an application for a mortgage. Evaluate your financial situation.

Dont change jobs or the way youre paid at the job. Web Dont change careers before applying for a mortgage. Web Start with your credit report The first thing lenders will probably do when you apply for a mortgage loan is to check your credit.

Web Be sure to take your time and carefully fill out the application as completely and accurately as possible. While youre waiting to close on your new home follow this advice to limit any bumps in the road. Choose a lender and commit.

If possible avoid becoming self-employed or changing from salary to commission during this time. Web What Are the Key Documents You Need to Gather for a Mortgage Application. So if you do the math youd have to plunk down 50000 on a 250000 house.

Web You can apply for a mortgage by taking the following steps. Web Online application. Review your Loan Estimates Step 3.

Web What not to do during the loan process. Web Making a major purchase like a car or furniture and charging a credit card right before signing for the mortgage to try to sneak it by a mortgage lender is still considered mortgage fraud. Dont Apply For New Credit Cards.

You dont need to memorize the process since your lender will guide you through each stage. Web Experts recommend keeping credit utilization under 30 to maintain a good credit score. Dont take on additional long-term.

Regardless of whether the application is in the paper format linked here an online form or done verbally with your loan officer this linked document contains the application with the information youll. If its above a certain threshold typically 43. If your credit score is between 500 and 579 the down payment requirement jumps to 10.

Web Once you complete the application and begin the mortgage process its important to keep your finances as similar as possible until closing. Not disclosing credit problems up-front or holding back requested documents will only delay the process and potentially prevent mortgage approval so its to your benefit to fully disclose everything about your finances. A loan officer can walk you through each section and give you feedback along the way.

Theres no better time for regular credit monitoring than when youre trying to prove your creditworthiness to a lender so you can get the best possible rates. The first thing youll do when applying for a mortgage is complete a federally required mortgage application. Even if you have.

Web Now that youre ready to apply for a mortgage its important to know what actions to avoid in order to save yourself from being denied a loan. Dont change employers quit your job or become self-employed.

L897ltmui7ohtm

44 Sample Joint Lease Agreements In Pdf Ms Word

Mortgage Application Denied Here S What To Do Forbes Advisor

What Is Fannie Mae Purpose Eligibility Limits Programs

Microfinance Loan How To Apply For Microfinance Loan

Mortgage Banker Vs Broker Top 8 Difference To Learn With Infographics

Summerside Real Estate Edmonton 44 Homes For Sale Page 2 Zolo Ca

44 Useful Gifts For Homesteaders That They Ll Really Appreciate The Homestead Guide

What Not To Do When Applying For A Mortgage In 2023 Curbelo Law

Independent Houses Near Neral Railway Station Thane 44 Houses For Sale Near Neral Railway Station Thane

Mortgage Document Checklist What You Need Before Applying For A Mortgage

Raleigh Houses North Buxton 44 Houses For Sale Zolo Ca

9 Dos And Don Ts Of Applying For A Mortgage Mortgageladder

24558 Va Real Estate Homes For Sale Redfin

44 Merrickville Houses For Sale Zolo Ca

Why Mortgage Applications Get Rejected What To Do Next

Top 10 Mistakes To Avoid When Applying For A Mortgage Penfed Credit Union